Orders, in the context of financial markets, are instructions given to the exchange to buy or sell certain asset.

In order to be able to trade in the crypto markets, you need to know what kind of orders you can make and what are their specifics.

Although crypto orders are basically the same as orders in other financial markets, there are some features you need to be aware of. It is common in financial markets for traders to interact with each other not directly but through brokers. This is not the case in the world of cryptocurrencies.

Following the ideology of straight-through peer-to-peer communication between parties, buy and sell transactions take place directly, without an intermediary.

Crypto exchanges maintain information about the liquidity and depth of the market in an electronic register called Order book. There, in an extremely transparent way, each user can track the available pending orders for purchasing and selling cryptocurrency. The order book contains data on available price levels, as well as the amount of currency that can be bought / sold at those levels. Each line represents one (or several agregated) pending order, with which someone has declared his readiness to make a deal for a given volume of the cryptocurrency at a given price.

The more pending orders there are in the order book, the greater the depth of the crypto market.

The difference between the best price announced in a pending buy order (bid price) and the best price in a pending sell order (ask price) is called spread. The smaller the spread, the more liquid the market. This is a sign of good trading conditions, stability and low volatility.

When a buy or sell order is received, the electronic register tries to execute it at the best available price. Depending on the available volume at this price level, the outputs can be two. If the requested amount of cryptocurrency is less than what is available (at this price level), the order will be executed with exactly this price. However, if the available volume is not sufficient, the register will move to the next best price level, adding to the required volume. Thus, the final net execution price will be different from the best price available at the time of placing the order. This difference is called slippage.

Crypto exchanges offer different set of order types. Depending on their way of execution orders are divided into market and pending orders.

CRYPTO MARKET ORDERS

The market order is executed immediately at the best available price. This is the simplest way of putting an order. The trick is, depending on the liquidity and volatility of the crypto market, the buy market order or sell market order may be filled with slippage.

Buy Order

The market Buy order is the fastest way to buy, as no conditions are to be met in order to execute the order. Because it needs to be filled immediately, the market buy order is known as “taker” as it takes part of the available market liquidity. That is the reason why it is charged higher fees.

Sell Order

The market Sell order is an order that is executed immediately, as no conditions are to be met. Because it needs to be filled immediately, the market sell order is known as “taker” as it takes part of the available market liquidity. That is the reason why it is charged higher fees.

CRYPTO PENDING ORDERS

Pending orders are those that are initially just added to the order book of the crypto market, to wait for execution. They hold some conditions that need to be met before the order can be filled. Because they provide liquidity to the market they are called “makers”. Lower execution fees are usually charged for executing a pending order, compared to executing a market (or “taker”) order.

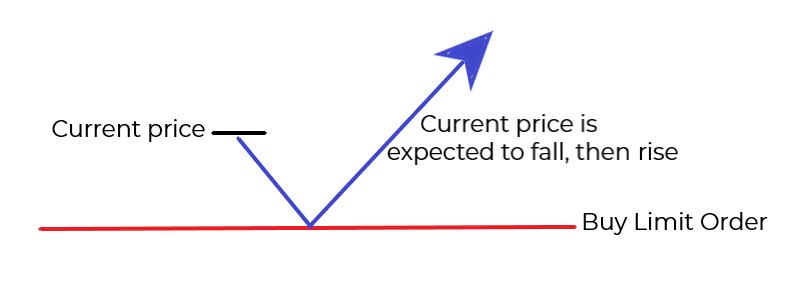

Buy Limit Order

Limit orders are “maker” orders. They wait to buy or sell an asset at a specified price or better. They cannot be filled at worse price levels than the limit price (so no slippage can occur). When submitted, limit orders enter the order book, thus providing liquidity to the market.

Buy limit orders are placed below the current market price. The time till the execution of the order is not fixed, but a matter of whether the market will reach the specified price level. In that sense, the buy limit order can remain untouched by the price, respectively not filled.

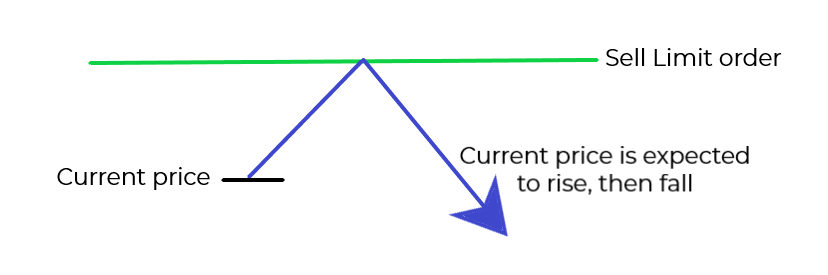

Sell Limit Order

Sell limit orders must be placed above the current market price. Just like the Buy limit the execution is not guaranteed. The sell limit order can remain untouched by the price, respectively not filled.

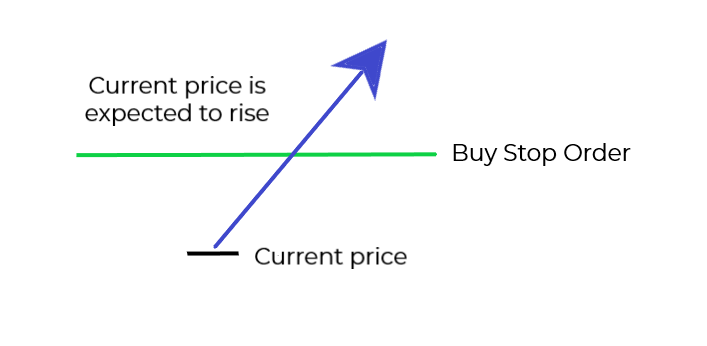

Buy Stop Order

The Buy Stop is a pending order to buy (open a long position) at a level, which is above the current price. This order gives instructions to open a position at a price worse than the present, so it is used when the trader expects the price to continue up.

A typical situation to use the Buy Stop is at a breakout of a resistance level, when it is expected that the upward price move will continue.

Once the Buy Stop is reached by the market price it is executed as a market order, at the best available price.

Once the Buy Stop is reached by the market price it is executed as a market order, at the best available price.

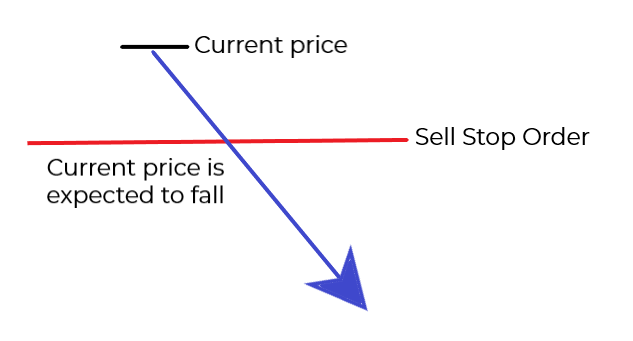

Sell Stop Order

The Sell Stop is a pending order used to sell (open a short position) at a level, which is below the current price. A Sell Stop order gives instructions to open a short position at a price worse than the currently available.

A typical situation to use the Sell Stop is at a breakout of a support level, when it is expected that the downward movement will continue.

Once the Sell Stop is reached by the market price it is executed as a market order, at the best available price.

TAKE-PROFIT AND STOP-LOSS CRYPTO ORDERS

There are variations of market orders that have the purpose of giving extra advantages to an open position, thus enhancing its risk/reward ratio.

Take-Profit Order

Take-profit orders are used to keep the profits. The price is set by the trader and is called a profit price. It represents the profit he plans to achieve. The take-profit order is placed below the current market price when it is used with a short position and above the current market price when it would close a long position.

Once the take profit price is reached the order is executed as a market order, at the best available price. So, it could be filled with slippage.

Stop-Loss Order

Stop-loss orders are designed to minimize the loss if the price changes unfavorably, hence the name. The trader sets the price for the order, called “stop price”. Stop-loss orders that protect a short position are placed above the current price and stop-loss orders that protect a long position are placed below the current market price.

Though the stop-loss order is a somewhat pending order, it is not added to the order book. When the market price reaches the stop price the order is triggered and executed as a market order. This means that there is a chance the stop order will be filled at a different price than the stop price, in other words – may be a subject to slippage.

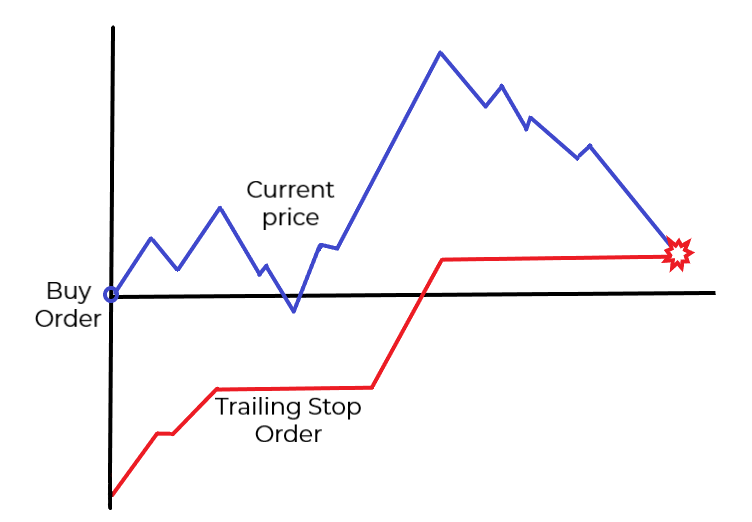

Trailing Stop Order

The trailing stop order works like the stop-loss order but in a more flexible manner. The stop price of this order is not fixed, instead it moves in relation to the market price. It is set to a fixed percentage or a fixed amount from the market price and as long as the market price moves in the desired direction, the trailing stop order follows (or trails) behind.

If the market price pulls back in the opposite direction, the trailing order stops in place. If the price continues its path and hits the stop, it is triggered and executed as a market order. The trailing stop buy order is placed above the market price and the trailing stop sell order is placed below it.

It is essential to correctly determine how far away from the market price to set the trailing stop. Putting it too close to the price means any minor correction could trigger the stop and end the position prematurely. Too far away on the other hand means it may never serve its protective purpose.

There are many more types of orders available on the crypto markets, of course. These were just the basic ones, but as every building needs a sound foundation, you need to work your way up step by step, starting from floor 1.