Trading in the FX market is possible 24 hours during the weekdays.

This is an advantage over centralized exchanges that have working time and close for a certain period of time.

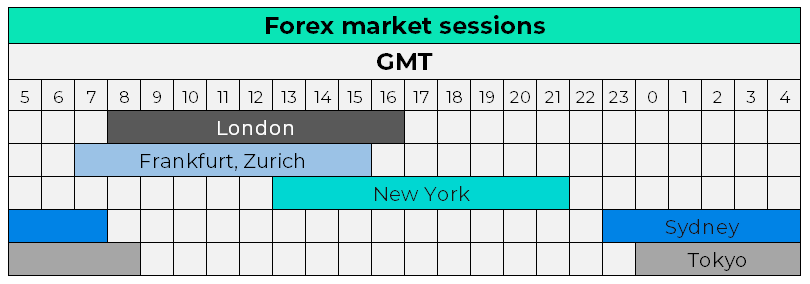

It is important to know the main trading sessions and the largest financial centers.

⇒ Asian – main financial centers in this area are Sydney (working hours 11 p.m. to 7 a.m. GMT) and Tokyo (0 a.m. to 8 a.m. GMT).

⇒ European – main financial centers are Frankfurt and Zurich (both operating from 7 a.m. to 3 p.m. GMT) and London (8 a.m. to 4 p.m. GMT).

⇒ American – main financial center is New York (1 p.m. to 9 p.m. GMT).

Fixings are another thing that you should keep in mind, besides the opening and closing hours of the major financial centers.

Fixings are primarily used by banks for expiration of options and forwards.

The most important of those are:

⇒ Tokyo fix – 0:55 GMT. It changes depending on daylight saving time, so it’s either 0:55 a.m. or 1:55 a.m. GMT. Japanese companies have major import and export activity, so large flows of orders in Japanese yen pairs are generated around the Tokyo fix.

⇒ Tokyo cut – 7 a.m. GMT. It is used for expiration of options and forwards by Japanese and other companies, though trading is not as active as it is around the Tokyo fix.

⇒ ECB fix – 1:15 p.m. GMT. The main flows of orders are in euro.

⇒ New York cut – 10 a.m. New York time, which is 3 p.m. London time (when switching to daylight saving time for a few weeks it is at 2 p.m.). Most forex options expire at the New York cut.

⇒ London fix – 4 p.m. GMT. It is connected to the largest financial center, that is why it is actively used by market participants. Very large cash flows are generated around the end of each month during the London Fix and sometimes volatility is very high.

Different people are active throughout the working hours of the different financial centers.

This could mean difference in the traded volume, as there are centers, significantly larger in size that, when active, provide more liquidity to the market. The overlapping of the trading sessions may also lead to an increase in liquidity.

Traded pairs are also dependent on the working hours of their native financial centers.

While there are major currency pairs like the EUR/USD which are actively traded regardless of the active sessions, less liquid currencies tend to be most active during the working hours of the geographically closest financial center.