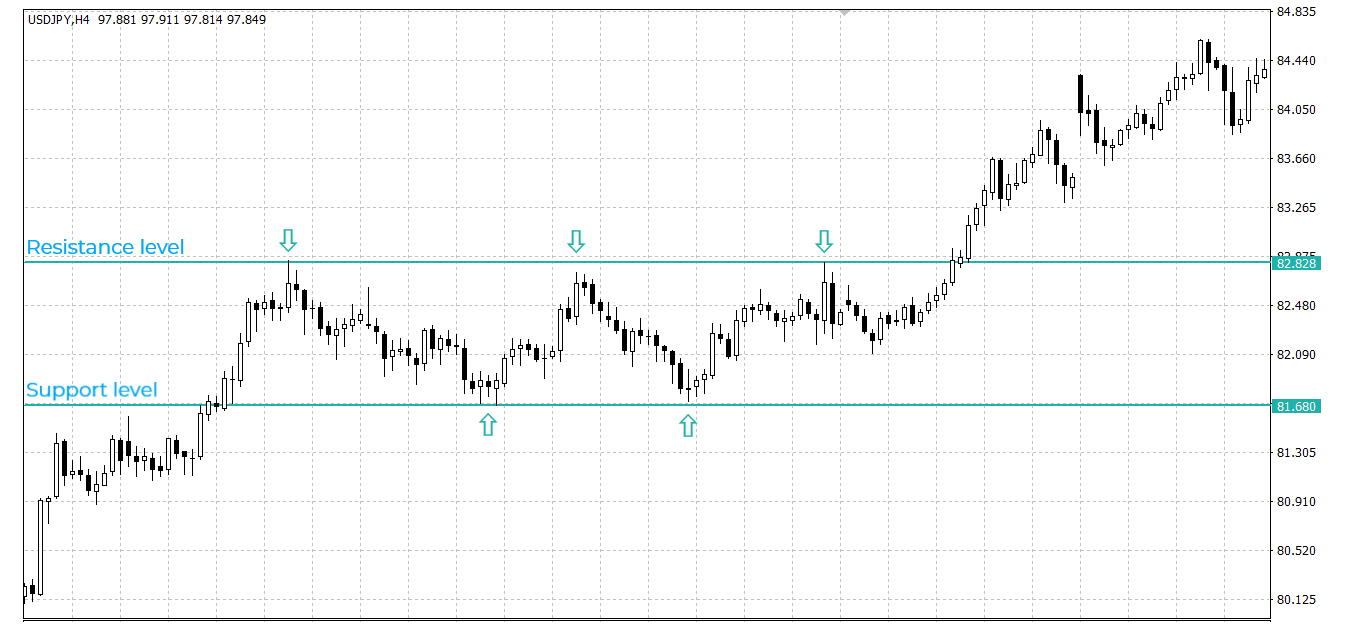

Support and resistance are levels that seem to limit the price from going further.

The support level is where the price stops falling and bounces back up. The resistance level is where the price stops rising and heads down.

Sometimes the price breaks the support or resistance line just by little and then returns into the price channel.

This is called testing of the level.

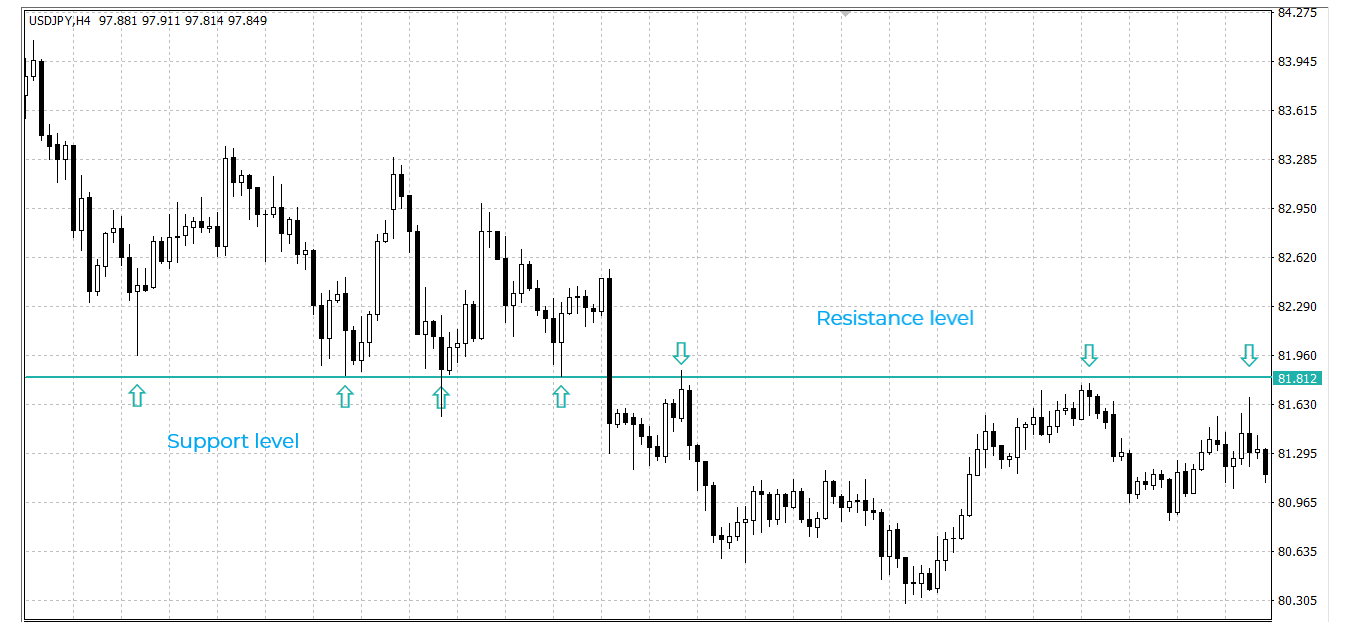

If the price breaks through one of the levels and doesn’t turn back it is likely that it will continue until it reaches another support or resistance level.

One way of identifying levels of support and resistance is by looking at historical data.

Analyzing the price action for a longer period can easily give the levels where the price stopped rising or falling. There is good probability that they will act again.

However, as those levels might have formed under different circumstances, they may not be valid anymore.

During an uptrend, you could expect that levels of support would hold testing, while resistance levels might be broken.

This is because of the buying pressure that the uptrend applies on the resistance lines. It is the opposite for a downtrend.

When a support level is breached, it becomes a resistance level (and the other way around).

The lows and highs formed during the development of one trend, serve to determine the levels of support and resistance for the new trend in the opposite direction. The logic is that the same factors, that led the market to encounter difficulties in breaking the level, may act again.

Support and resistance lines are more than just static horizontal levels.

Trendlines and different technical indicators serve as dynamic support and resistance lines for the price action.

Round numbers are a very interesting price barrier.

Traders tend to prefer these levels for placing their pending orders. As more and more people choose the same round number, it becomes a noticeable level of support or resistance. Although this is more of a psychological phenomenon, rather than an objective barrier, round numbers are something a trader needs to comply with.

The longer a level has withstood testing the stronger support or resistance it is.

This is because with time more and more people notice the level and use it to put their pending orders around it.

Weak levels of support or resistance are more easily broken, while major levels of support or resistance are more likely to turn the market back in the opposite direction.