Stocks can be classified in a number of different ways. Two very common classifications are by market-cap and by sector.

Market capitalization is the total market value of a company’s shares on the market.

It is derived from the total number of shares multiplied by their current price. This classifies the companies to large-cap companies with market capitalization of $10 billion or more, mid-cap companies with market cap between $2 and $10 billion and small-cap companies with capitalization between $300 million and $2 billion.

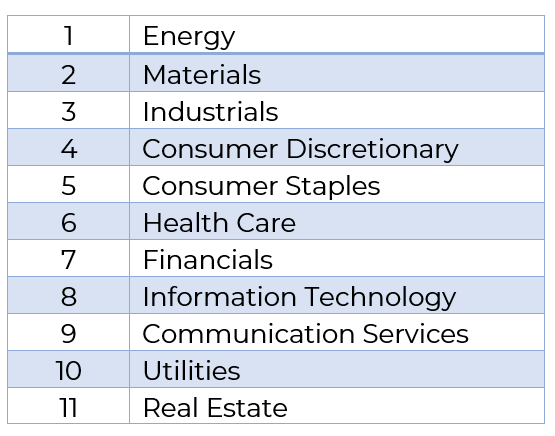

The classification system by sectors divides the companies to 11 sectors:

Some sectors are considered more defensive than others. They are preferred by investors for their better price stability and attractive dividends. Such sectors are health care and utilities. More aggressive investors choose the riskier sectors, such as technology, energy and financials.

Stock prices

The issue price is the price at which the company sells its shares during the IPO. From there on, it’s mostly supply and demand that shape its price.

If the demand is higher than the supply, the price rises, and the opposite leads to a fall. A trade transaction happens when a buyer accepts the ask price or when the seller accepts the bid price of the stock.

The difference between the ask and the bid is the spread. The narrower the spread, the better the liquidity in the exchange. If there are many buyers and sellers who have posted orders with different prices, the market is said to have good depth.