There are different types of orders to meet the needs and likes of all market participants. The main orders in the stock market are the market and the pending order.

MARKET ORDERS IN THE STOCK MARKET

The market order is the most basic type of order. It executes an immediate buy or sell trade at the best available price. If you are buying stocks, you will pay the ask price (or a price near the ask) and if you are selling, you will receive the bid price (or a price near the bid).

The price of execution may be different from the last traded price, especially in more volatile markets. The market order is often executed with some slippage, though in a market that deals with thousands of orders daily, it is rather small.

PENDING ORDERS IN THE STOCK MARKET

Pending orders are instructions to the exchange to buy or sell at a pre-defined level. The trade will be activated when the price reaches the limit price and will only be executed at a price equal to or better than the limit price.

There are 4 main types of pending orders.

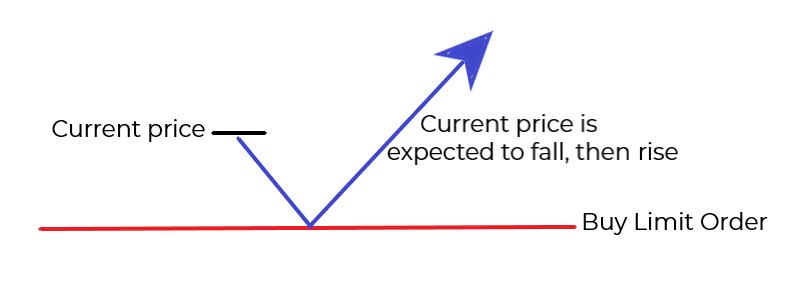

⇒ The Buy limit order is placed at a price level below the current market price and will buy the security at a price better than the current.

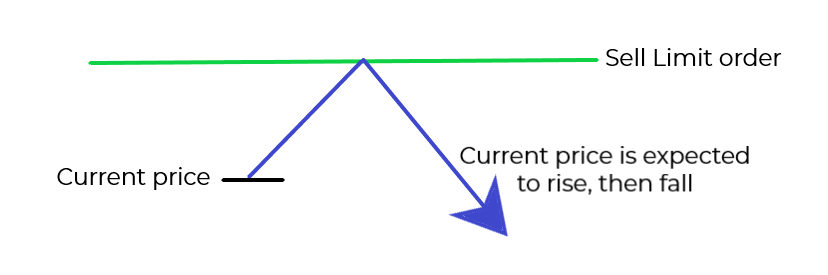

⇒ The Sell limit order is placed above the current market price and will sell a security at a price above the current.

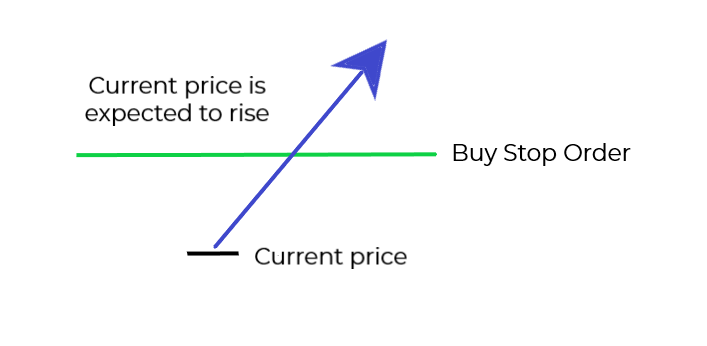

⇒ The Buy stop order is an order that is placed above the current market price. As it gives instructions to buy at a level that is worse than the current, it is used when a rise in the price of the security is expected.

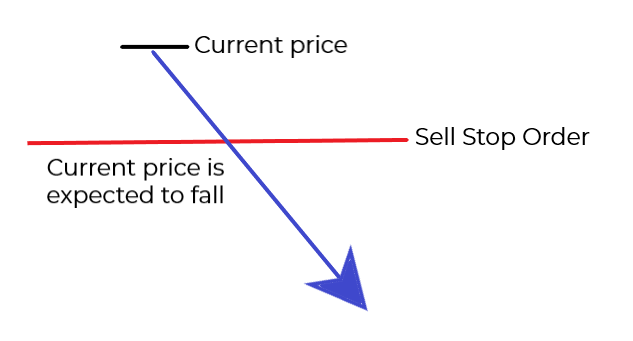

⇒ The Sell stop order would sell a security at a price lower than the current market price. Accordingly, it is used when it is expected that the price of the security will fall.

It is good to know these common types of orders. Each of them gives a different perspective in the market and broadens the opportunity for profitable trades.