The quote always has two currencies.

When we make a trade, we buy one of the currencies by selling the other, or the other way around.

When we’re buying the currency pair, we’re actually buying the base currency (the first) by selling the quote currency (the second). When we’re selling the pair, we’re selling the base currency (the first) by buying the quote currency (the second).

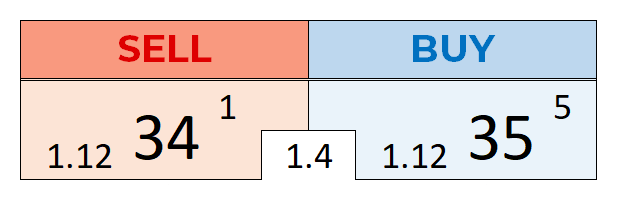

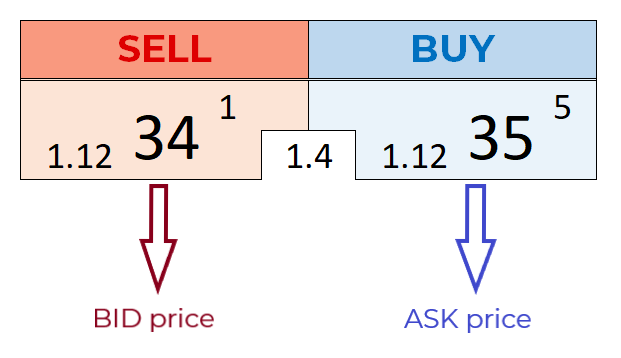

There are always two prices on the trading platform for a currency pair. It’s a bit confusing at first, but keep in mind that the prices are from the perspective of the broker.

The lower of the two is the Bid (Offer).

This is the price at which the broker would buy from you. This is the price that he is offering to you. It is your sell price (for opening short positions).

The higher price is the Ask.

It is the price that the broker would sell to you. This is what he would ask you to pay. This is your buy price (for opening long positions).

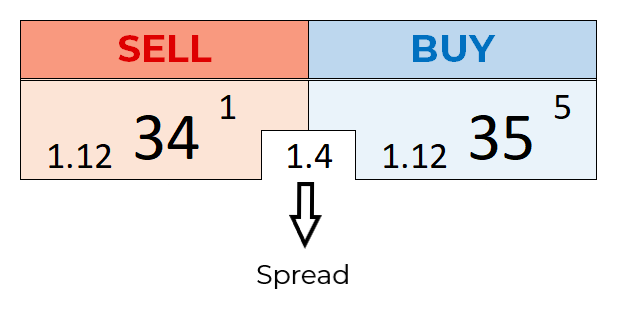

You always buy at the higher price and sell at the lower, so you, in a way, always start with a little loss, that you need to overcome in order to have a winning position. It is a kind of cost or commission for the transaction. This commission is the profit of the broker. It is known as spread.

THE SPREAD

The spread is the difference between the Bid and the Ask price at a given moment. It is not just the brokers’ earning, but a valuable piece of information. It is a telltale of how liquid and how volatile the market is.

Major currency pairs tend to have narrower spreads, sometimes less than 1 pip. This is because these markets are very liquid, with huge trading volume, and low volatility. Emerging currency pair markets generally have a higher spread compared to major currency pairs. This is because liquidity in those markets is lower, and volatility – higher.

Spreads can vary, even throughout one trading day.

Big news events, or the release of important economic data can cause turbulence in the markets. Just like retail traders, large liquidity providers prefer to play it safe in times of uncertainty. That is why they look to offset some of their risk by widening the spreads. When all the dust settles, spreads return back to normal.

Spreads are usually kept fairly reasonable as a result of the stiff competition between the numerous market makers. Although there may be differences between the brokers, spreads are usually the same or almost the same.

PIP AND PIPETTE

In the physical world where you can touch the money, the smallest you can have is one cent (if we take the US dollar). You cannot have less than that. In the digital forex market this is simply not enough. Prices are typically quoted to the 4th decimal place, with the exception of JPY pairs, that are quoted to the 2nd decimal place. The pip is the digit in the last position. It is in the 5th position, if counting the digits of the quote.

Pips may be unusual to the physical world, but this is a very common feature of the foreign exchange market. This is the norm for measuring changes in the price of the currency pairs.

For example, if the EUR/USD price moves from 1.1234 to 1.1236, it has moved up by 2 pips. If the price then moves from 1.1236 to 1.1224, it has moved down 12 pips.

The spread is also measured in pips.

If the EUR/USD bid price is 1.1234 and the ask price is 1.1235, then the spread is 1 pip. The short way to present this is EUR/USD = 1.1234/35.

The last few years paved the way to an even smaller measure unit – the pipette.

It’s a tenth of a pip and with its introduction the quotes started showing 5 decimal digits (3 decimal digits for the JPY pairs). The pipette is in the 6th place (the last) of all the digits in a quote.

Trading platforms usually show the pips via larger digits, while the pipettes are a small digit to the right of the pips.