Leverage is the use of borrowed money in the forex market in order to open larger positions. This is called leverage trading or margin trading. Margin is the amount the trader deposits to the broker for the opening of the leveraged position.

The Forex Market offers the highest leverages, compared to other financial markets.

In fact, many choose to participate in this market for this precise reason.

These high levels are possible for several reasons.

The forex market is the most liquid market in the world and the normal intraday volatility for the main currency pairs is relatively low (about 1%). This means two things. One, to make high enough profit, traders need large positions.

And two, from the broker’s perspective, it’s relatively safe to give this “loan”, as long as the margin is there, to cover the losses, if any.

Another favorable reason is that, again thanks to liquidity, it’s easy to enter and exit a trade at the desired level, in comparison with other less liquid markets. So, a properly managed leveraged trade has more than good risk parameters.

Leverage is widely used by traders.

It increases the buying power of the trader, at the same time using only a part of his equity.

Different brokers provide different leverages and new trading accounts can sometimes be allowed smaller leverage, adding a layer of security for both trader and broker. Because although dealing with leverage is an excellent opportunity, it must be used properly and with a very good degree of understanding.

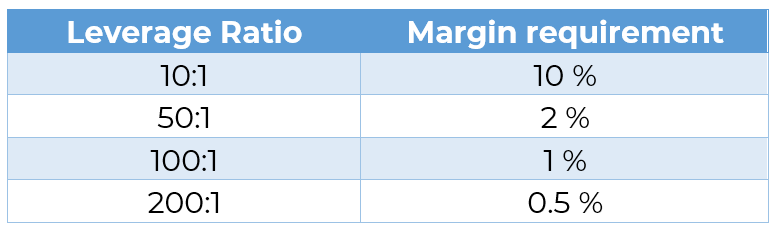

The leverage ratio provided by brokers in the forex market is normally up to 30:1 for European and 50:1 for US brokers. A 10:1 leverage ratio means that for every $1 (or any other currency) in the trader’s account, he can open a position worth $10. So, if that trader decides to risk $5 (that would be the margin), he opens a position for $50 on the market. In other words, with his $5 the trader opens a position 10 times larger. In still other words, the $50 position that the trader opens, has a 10% margin (his $5).

The margin is deposited with the broker as collateral.

Margin is often mistaken with a fee or a cost of the transaction, but it is not.

While the position is still open, the margin is blocked by the broker and the trader cannot use it. However, once the position is closed, the margin is released and is available to the trader.

It may sometimes be confusing to calculate all the elements for the leveraged trade.

Thankfully, technology has advanced enough to eliminate the need for the sheet of paper and the pencil. The smart way today is to use leverage and margin calculators that do the math for you, this way facilitating trading and giving you the opportunity to change an element and have the others recalculated in a matter of seconds.

It is possible to leave a leveraged position opened overnight. For the purpose FX swaps are used.

Unlike regular loans where you always pay interest, the swap can sometimes be favorable for the trader, adding to the profit of the position.

Although margin trading provides opportunities for significant profits, leverage can also work against traders. If the price of the currency pair moves in the opposite direction, leverage can amplify the potential loss. To minimize the chance of something like this happening, proper management should be applied, including the placement of a stop-loss and a take-profit order.

Traders must learn to risk as much as they’re prepared to lose for a given position.

Brokers also have a way of defending their position. After all, as the trader only provides a small percentage of the whole amount of the position (the margin), the broker is at risk too.

The so-called “margin call” is the broker's emergency brake.

In short, if the open position generates large enough loss (within the margin value) the broker closes it at the current market price. This, in short, limits the loss, for both trader and broker.

The forex market monitors the smallest of change in the price of the currency pairs. One pip is just 1/100 of the cent, which means that when a pair (like EUR/USD) moves 100 pips (and that is a lot) the price has moved just 1 cent.

This is the reason why currency transactions must be carried out in sizable amounts, to allow these minute price movements to be turned into larger profits.

Leverage is a unique tool, but it must be used wisely.