The Forex market is the largest financial market in the world. This is where the exchange between different currencies is conducted. More than 5 trillion US dollars are transacted through the FX market each day. Currencies are exchanged for all kinds of reasons – from an online purchase of goods ...

Trading Hours of the Financial Markets

Trading in the FX market is possible 24 hours during the weekdays. This is an advantage over centralized exchanges that have working time and close for a certain period of time. It is important to know the main trading sessions and the largest financial centers. ⇒ Asian – main ...

Major Market Participants

Knowing the market participants is essential. Every one of them is on the market for a reason – some are there for speculative purpose, others for non-speculative (commercial) one. The non-speculative participants use the forex market to exchange currencies, e.g. for the needs of import/export trades. They ...

Types of Transactions in the Financial Markets

Every transaction in the markets is a two-way deal consisting of a purchase of one currency (or asset) and a sale of another currency (or asset), at a given date. There are multiple variations for the parameters of the deal that give a wide range of opportunities for the trader. Knowing those characteristics is an important ...

Types of Orders

When trading in the forex market one should have good knowledge of the different types of orders and how and when to use them. The order reflects the trader’s intentions for entering and exiting the trade, so their precision can mean the difference between a profit and a loss. Multiple actions can be included ...

Leverage and Margin

Leverage is the use of borrowed money in the forex market in order to open larger positions. This is called leverage trading or margin trading. Margin is the amount the trader deposits to the broker for the opening of the leveraged position. The Forex Market offers the highest leverages, compared to other financial ...

Forex Market Quotations

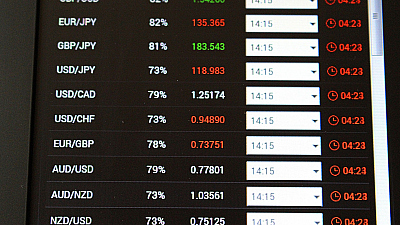

All currencies in the forex market are expressed in pairs. In order to value one currency, it needs to be compared to the value of another. This is what the quote presents. It is the price of one currency in terms of another. Or, the quote shows how many units of one currency is worth one unit of the ...

Currency Pairs

MAJORS There are currency pairs that are more important than the rest. They are called Major currency pairs. They are the native money of the most powerful and influential world economies. Because they are traded globally, the forex pairs that they form are extremely active in the market. MINORS Then ...

Reading the Quotes

The quote always has two currencies. When we make a trade, we buy one of the currencies by selling the other, or the other way around. When we’re buying the currency pair , we’re actually buying the base currency (the first) by selling the quote currency (the second). When we’re selling ...

The Forex Market Brokers

There are two levels in the forex market . The first is the interbank market. The biggest banks trade with each other there and although there are few members of this tier, the transaction volume is huge. The second level is the over-the-counter market. This is where all other market participants operate through brokers. ...

The Stock Market

The stock market is a market where traders and investors buy and sell stocks, along with other securities in a safe, controlled and regulated environment. One of its main purposes is to ensure fair and transparent pricing of the stocks. This market is not one place, although many often call it Wall Street. ...

Stock Market Structure

The stock market facilitates two general activities related to shares and so it is divided to Primary market and Secondary market. The primary market allows companies to issue and sell their shares to the public in a process called Initial public offering (IPO). This is the moment when a private company ...

Stocks - Classification & Pricing

Stocks can be classified in a number of different ways. Two very common classifications are by market-cap and by sector. Market capitalization is the total market value of a company’s shares on the market. It is derived from the total number of shares multiplied by their current price. This classifies ...

Types of Orders in the Stock Market

There are different types of orders to meet the needs and likes of all market participants. The main orders in the stock market are the market and the pending order. MARKET ORDERS IN THE STOCK MARKET The market order is the most basic type of order. It executes an immediate buy or sell trade at the best available ...

Stock Market Indices

Apart from monitoring the prices of individual stocks, investors are really interested in the stock market indices (also called indexes). Indices are aggregated prices of different stocks where the movement of the index price is the net movements of the different components in it. A very important index ...

Stock Market Exchanges

The largest stock exchanges in the world are the New York Stock Exchange (NYSE) and the Nasdaq, based on the total market capitalization of their listed companies. This is a list of some of the largest stock exchanges in the world. NYSE remains one of the world's leading auction markets, although some ...

Options

Options are contracts that give an investor the right, but not the obligation to buy or sell the underlying asset, at a certain price, over a certain period of time. They are a derivative financial instrument because their price is based on the price of the underlying asset, which could be a security, ETF or even an ...

Options Price & Profitability

The price of the option is called premium. Because options are derivative financial instruments, the premium price is derived from the price of the underlying asset, also referred to as intrinsic value. There is one more component that plays a significant role in determining the premium – the time value, also called ...

The Greeks

The market price of an option reflects the probability of it to be in the money at expiry and depends mainly on three factors: ⇒ The relationship between the strike and the current price of the underlying asset. The more an option is out of the money, the less likely it is to be in the money ...

The Commodity Market

A commodity is a raw material or a primary agricultural product that can be bought and sold. Not all materials and products qualify for a commodity because there are some conditions that need to be met. The item must be standardized and for the industrial and agricultural commodities – it must be “raw”. ...