Bitcoin is a profound invention, without a historical equivalent in the world of finance and monetary systems. Its core ability to transmit value over a transparent, immutable computer network is proving to be a game-changer that is just beginning to disrupt a paradigm that has been in effect for centuries.

In the years ahead, many, if not all traditional financial instruments will be reinvented and reengineered to utilize the benefits of the decentralized, permissionless protocols that are emerging today.

Banks, in their traditional form, serve as intermediaries that provide record keeping, verification, transaction, liquidity and security of the financial system. These critical functions are an inseparable part of the forces that drive the world today. Rooted back in the Renaissance age the principles of banking and corporate structuring are long overdue for an update. While we have seen some digitalization in the sector, it has been limited to accounting, online banking and algorithmic trading.

Decentralized Finance (DeFI) proposes a complete restructuring of traditional finance from the ground up. Permissionless access and execution, (pseudo)anonymous participation and decentralized book-keeping are the foundations and intermediaries will be at the layer on top.

Image via Defi Pulse.

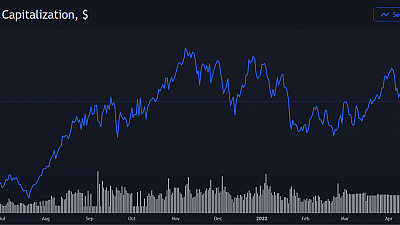

The expansion of DeFi has been anything but slow. Current Total Value Locked (TVL) sits at $75B, with an ATH of approx. $107B. It is still a small fraction of the $1.8T total market capitalization of crypto, and a spec of the global wealth of half of quadrillion dollars. However, the speed of adoption among investors is unprecedented. What started as affectionalled called “DeFi Summer” in 2020 is now at the table of conversations in central banks across the globe.

What started as a means for trading, borrowing, lending and staking between retail investors is now adopted by corporations looking to reshape their capital structures. Creators and businesses can incorporate tokens into their ecosystems, guaranteeing unmediated return of value, while incentivizing followers, customers or investors at the same time.

The latest foray in cryptocurrencies comes with a massive risk. In 2021 alone, DeFi users lost $10B in scams, hacks and exploits. That number is bound to increase. Oftentimes a DeFi protocol promises decentralization and an audited codebase, only to reveal itself as a heavily centralized scam or an (un)intentionally malicious dApp. The term “rugpull” has become a popular denomination for an anonymous team of developers disappearing with the assets of their users.

Related to our article on crypto regulations, DeFi is already in the scope of lawmakers. Politicians and Central banks are looking into the mechanics of decentralized finance, as a source of inspiration for the upcoming CBDC’s (Central Bank Digital Currencies). First to issue one was PRC with the Digital Yuan. As an incentive for adoption the Chinese government airdropped extra cash into the wallet of each user who was willing to participate. Only one, or rather several caveats: the extra CBDC should be spent in a certain period of time and only on certain goods. So far, the experiment has been unsuccessful. People are unwilling to use a permissioned digital currency and prefer to exercise their spending at a free will.