The two most distant financial markets in chronological and regulatory terms have much more in common, than what meets the eye.

Under the broader moniker of fixed-income markets, the size of the traditional credit markets currently sits at above $120T.

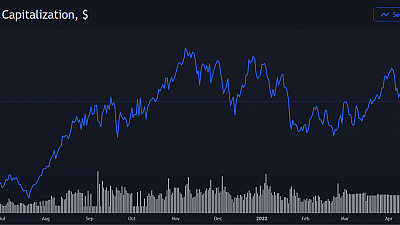

Image via TradingView

DeFi’s total market capitalization is around $130B (ТVL incl.), and is only a fraction of its credit counterpart. However, the rapid innovations in the former are bound to be applied in the mechanism of traditional finance.

In its current state DeFi conducts itself as an ad hoc laboratory experiment that comes with its breakthroughs and “explosions” (hacks, scams, etc.) alike. In due time, the market will outgrow the early adopters with a taste for high-risk investments (aka “degens”) and will disrupt tradfi.

Decentralized finance can bring numerous improvements, including, but not limited to:

Efficiency. Bonds are traded OTC, by institutions through brokerage. On the opposite side, DeFi is built and operates over a computer network, which greatly increases the efficiency of exchange and settlement, without the need of intermediaries.

Transparency. Whether it’s permissionless or not DLT (Digital Ledger Technology) provides an immutable record-keeping and accountability of every transaction executed onto it.

Liquidity. Various protocols develop and utilize technologies like AMM (Automatic Market Making) through deterministic pricing, Liquidity Providers (LP’s) incentivized by share of the fees, tranching, etc. Mostly classical mechanisms, but all of them are set into code.

Accessibility. Still difficult to navigate, DeFi is making strides into becoming more accessible to the everyday user. UX and ease-of-access are an integral part for public adoption.

What are the challenges before the integration of DeFi into the mainstream markets?

DeFi is still considered as an unsafe ground by many investors. Regulations are unclear at best or plain nonexistent. High transaction fees (addressed in the Layer 2 protocols) are still an issue. No investor/consumer protection and no clear tax guideline by the revenue agencies are also a major obstacle to adoption. The risk of a fiscal burden accrued for previous years (back taxes) is not something institutions and businesses are willing to undertake.

If DeFi continues to provide considerably higher yield, more and more capital is bound to flow into the ecosystem, further accelerating development and innovation.

According to this compendium by the International Capital Markets Association (ICMA) major financial institutions in the bond markets are rapidly digitizing, including a lot of the tools provided in DeFi’s arsenal.